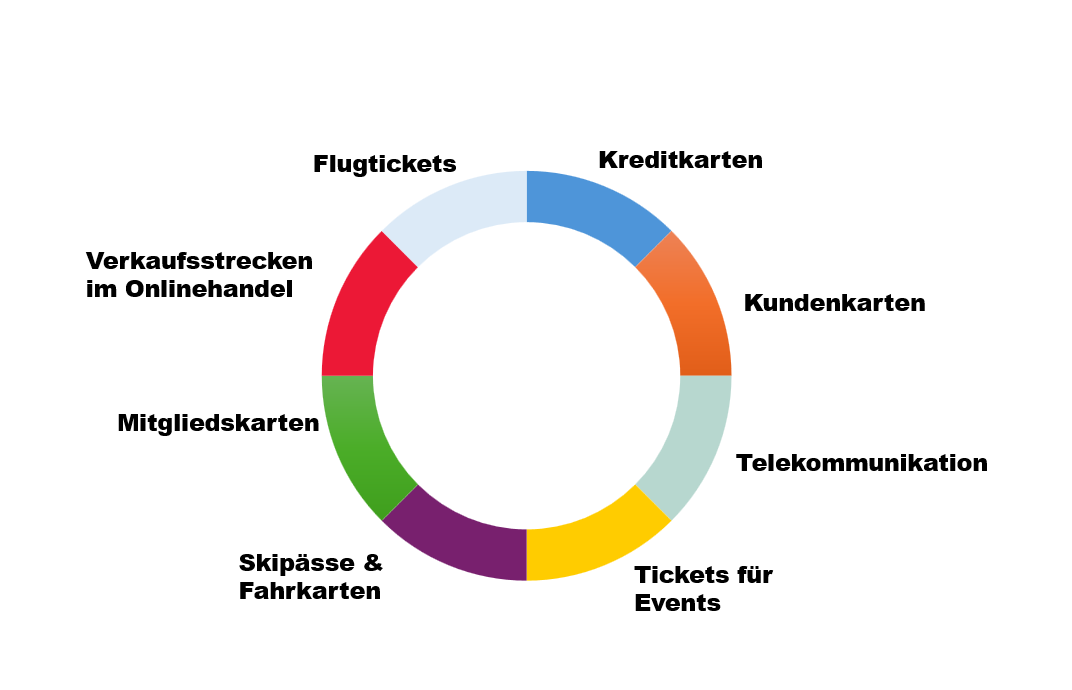

Your company offers a product, e.g., a customer card, tickets for events, or goods. These offers may include added value for customers: credit cards often include travel insurance, sporting events may include accident insurance, and car purchases may include tire protection. Something useful that makes your product even more attractive and gives you a competitive advantage.

We refer to this type of insurance as “integrated solutions” or “embedded insurance.” Incidentally, it is not only available for payment cards or admission tickets, but also for electrical appliances, large appliances, or vehicles.

Heat pump protection

Heat pump protection

All of our insurance solutions enable you to create added value for your customers. Insurance coverage is taken out or offered directly when the product is purchased, so your customers no longer have to actively search for suitable insurance.

All of our insurance solutions enable you to create added value for your customers. Insurance coverage is taken out or offered directly when the product is purchased, so your customers no longer have to actively search for suitable insurance. A credit card can include many useful extras, whether these are property insurance or personal insurance. For example, there are cards that offer travel insurance or protection against unemployment. As a card provider and business partner, you choose the type of insurance yourself. We are happy to advise you and put together individual and flexible packages. Around 35 million people* in Germany have a credit card. This means that demand is also growing for additional benefits that set you apart from the competition.

A credit card can include many useful extras, whether these are property insurance or personal insurance. For example, there are cards that offer travel insurance or protection against unemployment. As a card provider and business partner, you choose the type of insurance yourself. We are happy to advise you and put together individual and flexible packages. Around 35 million people* in Germany have a credit card. This means that demand is also growing for additional benefits that set you apart from the competition.